The landscape of cryptocurrency investment is a complex tapestry of opportunity and risk, with each thread representing a different digital currency. In today’s focus, we shall discuss Cardano, its recent performance, and what the future holds according to our current predictions.

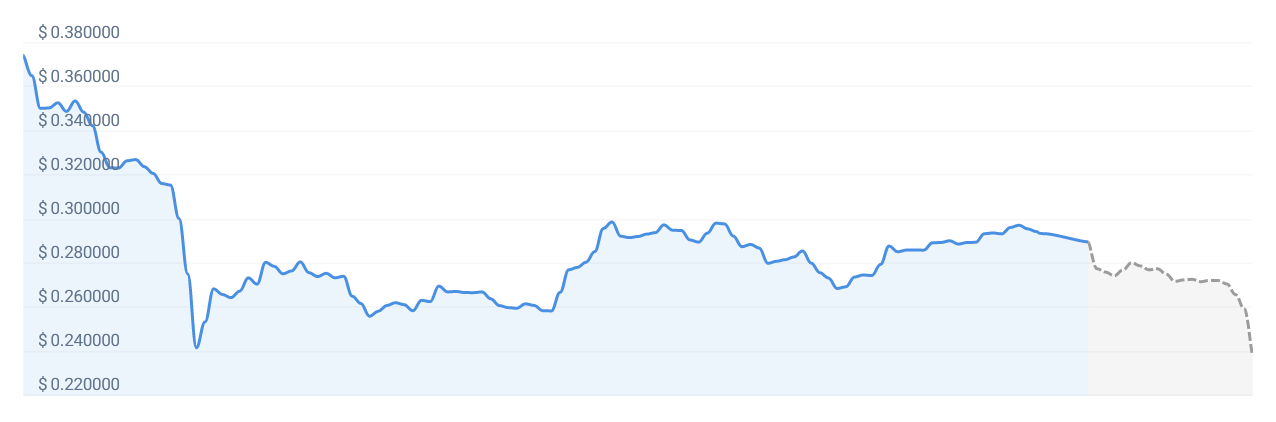

Our latest Cardano price prediction estimates a significant drop of approximately -18.63%, with its value expected to reach $0.238533 by July 10, 2023. It’s crucial to understand that these predictions are based on a rigorous analysis of various technical indicators, including the cryptocurrency’s past performance and existing market conditions. It might be disconcerting for existing and potential investors to anticipate such a dip, but it’s a testament to the volatile nature of the cryptocurrency market.

As for the prevailing market sentiment towards Cardano, our technical indicators present a bearish outlook. This sentiment is an analysis of various factors that suggest investors are more likely to sell than buy at present. Often, a bearish sentiment indicates uncertainty or lack of confidence in the coin’s near-term performance. However, it’s worth noting that market sentiments are fluid and can quickly shift based on numerous factors like news, market trends, or regulatory changes.

Interestingly, despite the bearish sentiment, the Fear & Greed Index for Cardano stands at 61, placing it in the ‘Greed’ category. This discrepancy highlights the complex emotions and strategies that underpin the crypto trading landscape. While ‘Greed’ suggests investors are currently motivated by potential high returns, the bearish sentiment could be indicative of an upcoming market correction or, perhaps, strategic sell-offs to secure current gains.

In the past 30 days, Cardano has shown a positive trend on 53% of the days, recording 16 out of 30 green days. A ‘green day’ in trading parlance refers to a day when the price of a cryptocurrency increases from its previous closing price. However, these green days come with a hefty 9.17% price volatility, which, while not uncommon in the world of cryptocurrencies, serves as a stark reminder of the inherent unpredictability and risks associated with such investments.

Considering all these factors, our current Cardano forecast advises caution for potential buyers. Although the Fear & Greed Index suggests an opportunistic market, the anticipated drop in value and bearish sentiment indicate that this might not be an optimal time to invest in Cardano.

However, it’s crucial to remember that these forecasts are based on current data and prevailing market conditions. The crypto market’s volatile nature means trends can shift rapidly. This is why constant vigilance and staying updated with market movements and related news is crucial for potential investors.

Indeed, the forecasted price drop may present an opportunity for strategic investors who believe in Cardano’s long-term potential. Historically, many cryptocurrencies have shown a tendency to rebound after significant drops, often reaching new heights. Hence, a price drop could offer an attractive entry point for those willing to accept the associated risks.

To conclude, while our current forecast paints a somewhat challenging near-term picture for Cardano, the long-term view remains as unpredictable as the crypto market itself. As with all investments, due diligence, continual learning, and understanding the volatility of the market remain paramount. Investing in cryptocurrencies is not for the faint-hearted, but for those who master the ebb and flow of this tide, the rewards can be significant. Remember, every forecast is a tool to help inform your decisions – not a guarantee of future results. Always consult with a financial advisor or conduct your own thorough research before making investment decisions.