In the dynamic and ever-evolving world of cryptocurrencies, the ability to adeptly maneuver between different digital currencies is a skill that embodies both the art and science of modern investment. This article dives into the intricate process of swapping Monero (XMR), the leading privacy-focused cryptocurrency, for Ethereum (ETH), the blockchain platform renowned for its smart contracts and decentralized applications. This swap is more than just a simple exchange of assets; it represents a nuanced transition between two fundamentally different blockchain philosophies and functionalities.

Monero and Ethereum: A Contrast of Crypto Ideologies

Before embarking on the swapping journey, it’s crucial to understand the unique attributes of Monero and Ethereum. Monero, born in 2014, stands at the pinnacle of privacy and anonymity in the digital currency world. It employs sophisticated cryptographic techniques like ring signatures and stealth addresses to ensure that transactions are not just secure, but also private and untraceable.

Ethereum, on the other hand, launched in 2015, revolutionized the blockchain realm by introducing the concept of smart contracts. These self-executing contracts with the terms of the agreement directly written into code opened up endless possibilities, leading to the birth of decentralized applications (dApps) and the expansion of the blockchain beyond mere financial transactions.

Why Swap XMR for ETH?

Swapping XMR for ETH can be driven by various motivations. For some, it’s a strategic investment decision, diversifying their portfolio to include a mix of privacy and utility-based cryptocurrencies. Others might be attracted to the wide range of applications and projects built on the Ethereum platform, from decentralized finance (DeFi) to non-fungible tokens (NFTs). Additionally, the swap could be influenced by the belief in Ethereum’s long-term potential as a foundational blockchain technology.

Navigating the Swap: A Detailed Guide

- Preparation and Security: Ensure you have secure wallets for both XMR and ETH. Given the privacy focus of Monero, choosing a wallet that aligns with its anonymity features is crucial.

- Choosing the Right Platform: Select a cryptocurrency exchange or swapping service that supports XMR to ETH conversions. Considerations include the platform’s security, fees, exchange rates, and user experience.

- Initiating the Swap: Deposit your XMR into the chosen platform. Once deposited, you can proceed to swap it for ETH. This involves specifying the amount of XMR you wish to swap and confirming the transaction details.

- Receiving Ethereum: Post-swap, the ETH will be transferred to your Ethereum wallet. This step completes the exchange process, but the time taken can vary depending on network congestion and processing speeds of the chosen platform.

The Timing and Market Considerations

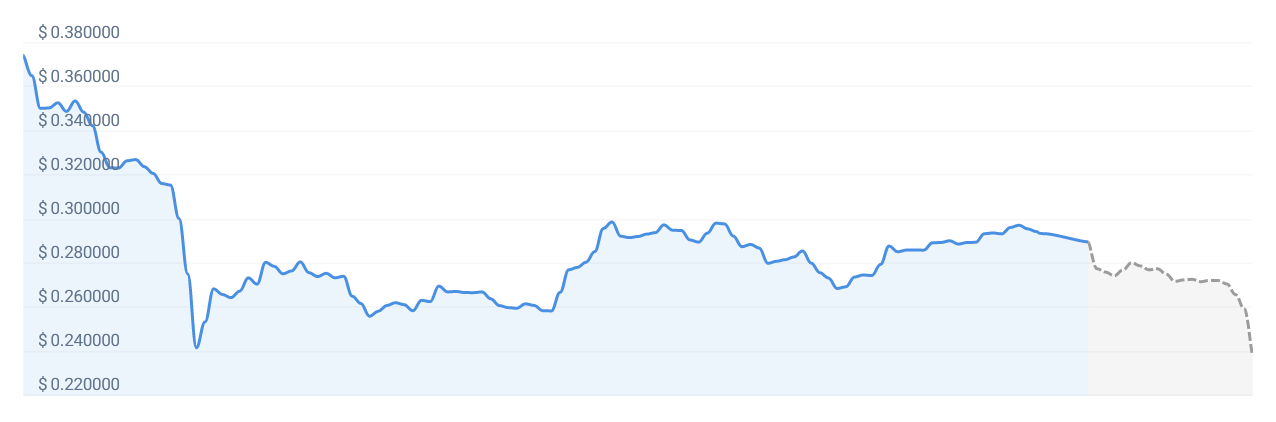

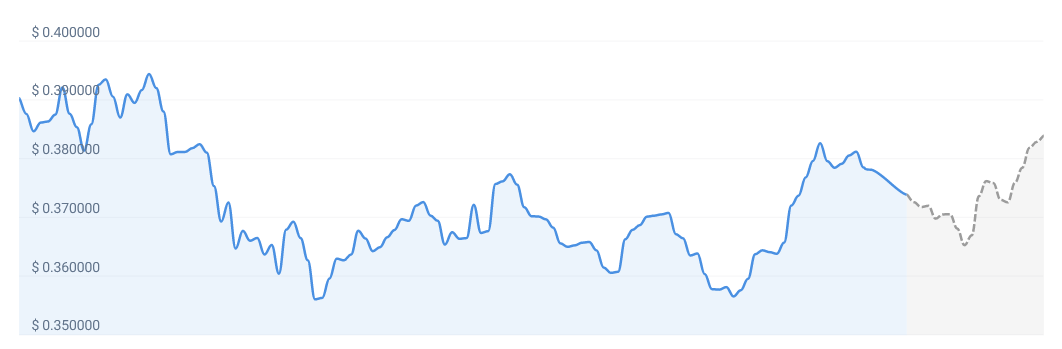

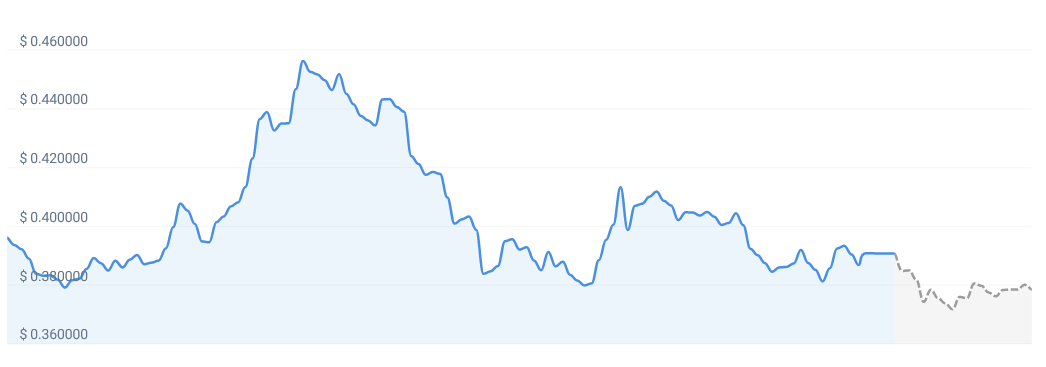

The timing of your swap can significantly impact the outcome, given the volatility of cryptocurrency markets. Staying informed about the latest market trends, news, and technical analyses is crucial. However, the unpredictable nature of the crypto market means that timing the swap perfectly is more of an art than a science.

Security Best Practices

Given the differing privacy approaches of XMR and ETH, maintaining security throughout the swap process is essential. Use reputable platforms, enable two-factor authentication where possible, and be vigilant about phishing scams. Remember, the security of your assets lies primarily in your hands.

Regulatory and Tax Implications

The legal and tax implications of swapping cryptocurrencies can vary widely depending on your jurisdiction. It’s advisable to consult with a financial advisor or a tax professional to understand the regulations and obligations in your region.

Ethereum’s Broadening Horizons

Understanding the broader context of Ethereum’s ecosystem can provide insights into the potential benefits of the swap. Ethereum’s transition to Ethereum 2.0, with its shift to proof-of-stake, promises improved scalability, security, and sustainability, potentially impacting the long-term value of ETH.

Conclusion: A Strategic Crypto Transition

Swapping XMR for ETH is more than a mere currency exchange; it’s a strategic move across the diverse landscape of blockchain technologies. This transition from the privacy-centric Monero to the versatile and expansive Ethereum network reflects a nuanced understanding of the different use-cases and potentials of each cryptocurrency. As the digital currency space continues to mature and evolve, such swaps represent not just financial decisions but also ideological alignments with the varying visions and capabilities of different blockchain platforms. Whether driven by investment strategy, belief in technology, or simple curiosity, swap XMR to ETH embodies the dynamic and multifaceted nature of the cryptocurrency realm.