Cardano is a proof-of-stake blockchain platform created with the intention of helping those with the power to change the world, bring about positive global change.

The open-source project’s goal is also to “take power away from unaccountable structures at the top and give it back to individuals on the margins.” Doing this would make our society more secure, transparent and fair.

Cardano was founded in 2017 and named after the 16th century Italian polymath Gerolamo Cardano. The native ADA token is named after 19th century mathematician Ada Lovelace, who is widely believed to be the world’s first computer programmer.ADA tokens give owners the right to vote on proposed changes to the software, meaning that they can play a role in how the network runs.

The developers of the layered blockchain believe that their technology- which makes it possible to create decentralized apps and smart contracts modularly- has already had some amazing applications.

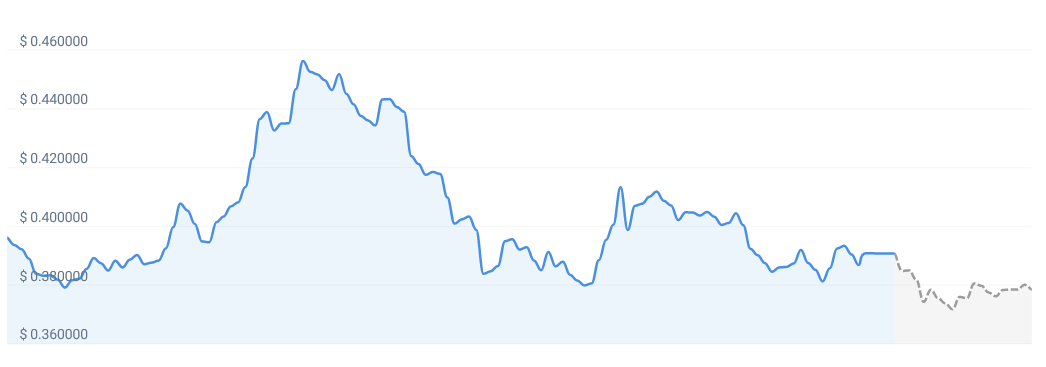

On Aug. 12, 2021, Charles Hoskinson announced the launch of the Alonzo hard fork for Cardano, causing the price of ADA to surge by 116% in the following month. On Sept. 12, 2021, the hard fork officially launched, bringing smart contract functionality to Cardano users. Over 100 smart contracts were deployed within 24 hours after launching.

Cardano is used by agricultural companies to track the movements of fresh produce, while other products built on the platform allow for educational credentials to be stored in a tamper-proof way, and retailers to put an end to counterfeit goods.

Cardano was founded by Charles Hoskinson, who is also the CEO of IOHK, the company that built Cardano’s blockchain.

In an interview for CoinMarketCap’s Crypto Titans series, Hoskinson stated that he became involved in cryptocurrencies all the way back in 2011. He did a bit of mining and trading before getting his first professional job related to cryptocurrency in 2013 when he created a course on Bitcoin which was taken by 80,000 students.

Hoskinson isn’t only a technology entrepreneur, but also excelling in mathematics. In 2020, his company donated $500,000 worth of ADA to the University of Wyoming’s Blockchain Research and Development Lab.

Cardano is one of the most successful blockchains to use a proof-of-stake consensus mechanism. PoS uses less energy than Bitcoin’s proof-of-work algorithm, making it more environmentally friendly. Even though Ethereum is much larger, its transition to PoS will happen slowly over time.

The Cardano team has made sure that all of the technology developed goes through a rigorous process of peer-reviewed research. This ensures that bold ideas can be challenged before they are validated, making the blockchain more durable and stable. By doing this, potential pitfalls can be anticipated in advance, making the project more successful overall.

The Shelley upgrade in 2020 aimed to make Cardano’s blockchain significantly more decentralized than other large blockchains. Hoskinson predicted that this would then enable hundreds of assets to be run on its network.

Alonzo’s hard fork launch in September 2021 will conclude the Shelley era and begin the Goguen phase. Users can develop and deploy smart contracts on Cardano, which will allow for native decentralized applications (DApps) to be built on top of its blockchain. On September 2, 2021, Cardano’s price broke the $3 mark and reached an all-time high of $3.101 in anticipation of the launch.